When an industry is nascent, typically stigmatized activities and grey market goods dominate traffic on the new substrate. Take the internet for example, adult content, pirated movies & music, games and commerce for grey market goods such as counterfeits were all very important drivers in onboarding new users and building out the internet’s infrastructure.

In a similar vein, highly speculative use cases such as leverage trading with perpetual futures, ICOs, DeFi, and NFTs have dominated the first ~8 years of crypto smart contract platform activity. Much of this speculative layer has been left to continue, unfettered with no KYC or AML restrictions. Unsurprisingly, speculative layer applications making use of crypto’s permissionless and serverless design have massive product market fit, especially for ICO “old money” that cannot truly enter the banking system.

These dollars circulate in the so-called ‘DarkFi’ realm, seeking yield and chasing opportunities. Many of the notable 500-1,000 wallets that dominate volume on many DeFi protocols and NFT marketplaces are the main characters of the DarkFi ecosystem. To be clear, DarkFi is neither good nor bad, it simply exists, a natural force in crypto.

Similar to the internet, DarkFi was absolutely necessary to get the industry from 0 to 1 initially, however the industry is beginning to graduate past this underground era and moving towards regulated businesses gaining relevance rapidly.

Thus, RegFi is gaining relevance. In most countries like the United States, the only way to be able to connect to people’s bank accounts for crucial fiat on-ramps and off-ramps is to be fully regulated and possess the requisite money transmitter licenses and KYC/AML controls. Even the best internet native go- to-market campaign on Twitter can’t compete with connecting to people’s bank accounts or opening your product to their retirement account. In fact, the principle catalyst and tailwind for crypto in this 2022-2023 bear market, the Blackrock BTC spot ETF is the result of RegFi, not DarkFi. In absence of all other narratives and primitives, crypto is a game of inflows and outflows, and RegFi wins at bringing inflows.

Many decry this trend is against the principles of internet freedom and decentralization that birthed the industry, however this is a necessary step in order to grow crypto past the niche underground sector it is today. Put simply, DarkFi got crypto from 0 to 1, but RegFi will get us from 1 to 100. However, both worlds are not mutually exclusive. The emergence of RegFi will not do away with DarkFi, because DarkFi will always exist in crypto, by design: cryptocurrencies are designed to be immutable, censorship resistant money and infrastructure anyone can tap into: DarkFi is going nowhere.

What does this mean for asset allocators looking at the crypto landscape? We have the unique privilege and responsibility of evaluating projects that can outperform on either extreme, without middle curving anything. We posit that the secular winners of the coming years will be squarely positioned at either extreme of the spectrum.

Like in most businesses, if you are not extremely strong at one particular thing, your market power will be eroded and eventually replaced by a stronger, more specialized player with a higher degree of operational scale. In this vein, the best RegFi players will be *fully regulated*, in possession of all the licenses and adjacent permits to conduct their business in a compliant manner indefinitely. Equally, the best DarkFi projects will address the most speculative and underground use cases you can imagine, serving the underclass of crypto old money in ways that are simply not possible by a RegFi company.

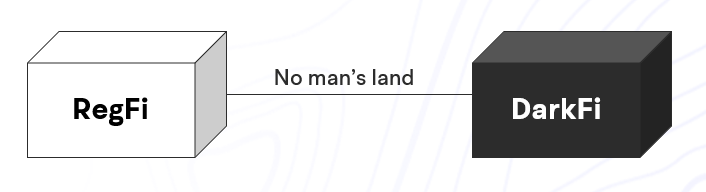

The best companies will avoid No man’s land, this is where you have the cost of regulation without the full benefits of DarkFi primitives: In other words, the worst of both worlds.

Interestingly, companies such as CEXs seem to be able to go from RegFi to DarkFi, but not from DarkFi to RegFi. Regardless of where you stand on the debate, it is clear we find ourselves in the midst of a shifting landscape. Don’t middle curve anything.

Note: This framework was inspired by conversations with Tom Howard of Network0, and he was the first person I spoke with to use the term “DarkFi” in this context.