This past week Solana DEX volumes exploded, with stablecoin volume increasing very rapidly as well. TVL is the age old ‘power rating’ of an ecosystem, however while it may be well known and easy to measure, TVL is also an easily manipulated and noisy metric that does not paint a clear picture of the nature of DeFi.

You can deposit Ethereum, borrow against it, and earn yield or use the proceeds to start a validator, however the more capital efficient means of price discovery are not possible on Ethereum given the limitations of 11-12 tps and gas fees in the $10-100 range on ETH L1. Due to their reliance on AMMs, in legacy blockchain ecosystems like Ethereum it takes much more TVL to generate the same amount of volume as on Solana, where central limit orderbooks (CLOBs) and concentrated liquidity market makers (CLMMS) are possible and commonplace.

To illustrate this, as illustrated by @SolBeachBum and @andrewhong5297, in the past week, both Solana had Ethereum had $40m of volume on their base asset / USDT pair, however Solana only needed $1m in liquidity, whereas Ethereum needed $73m in liquidity to generate the same volume.

In this particular case, Solana was able to generate 70x as much volume for a given level of liquidity!

This isn’t just big, this is a game changer which challenges the entire notion of TVL and its usefulness as a metric One can only imagine what volume will look like when TVL on Solana and similar chains reaches the billions again.

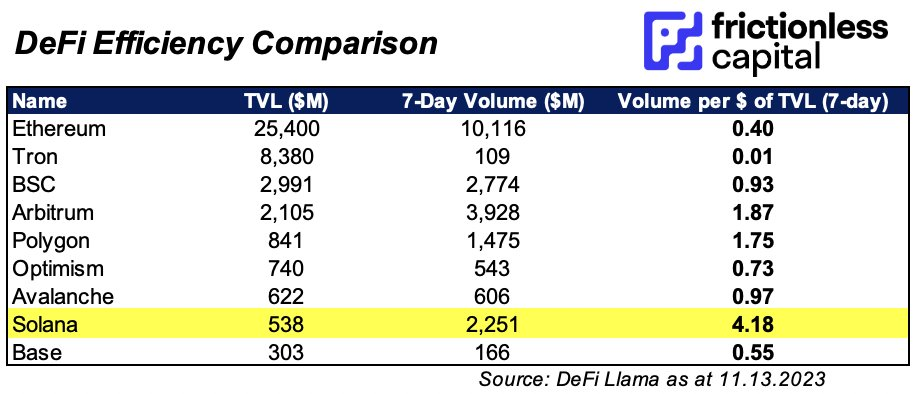

At Frictionless we would liken this almost to a DeFi efficiency or utilization metric, and by pulling some of the data of Solana versus its peers (h/t @bennybitcoins) from @DefiLlama we can observe a stark contrast:

Over the past 7 days, Solana has done ~$4.2 of volume per $ of TVL, over 10x as much as Ethereum. Note, despite Tron’s massive $8.3b TVL, it is doing ~420x less DEX volume per $ of liquidity than Solana. You can expect the volume/liquidity ratio to be an absolute mainstay going forward, it is not only about how much liquidity you have, but how efficiently and actively you are using it.