Solana has been criticized for 4 main points, we’ve all heard them many times:

- Downtime & Outages “Solana goes down every 5 mins”

- Centralization “It’s a centralized database chain, SQLANA!”

- Inflationary Tokenomics “The inflation rate is unsustainable!”

- FTX’s Involvement “FTX controlled SOL and it won’t survive without them”

In this article we will take these points head-on and provide you with the publicly available facts and arguments to dismantle these points.

At the end, we will also cover some of the main tailwinds that Solana has heading into 2023 that could be major drivers of user and developer activity in the future.

Since Satoshi’s whitepaper was published in 2008, the crypto space has embarked on a period of experimentation that continues to this day. Protocol architects and designers have pursued different trade offs and optimizations to attract developers and users. History has shown that in a tech race the winner is almost never decided in the first or second iteration. With every iteration, innovators uncover new and interesting blockchain properties and features that push the space forward in leaps and bounds. Every so often, a profound innovation occurs that changes the course of blockchain design and development forever. Today, as a key innovator in the space, Solana is under attack by critics and detractors.

In this piece we will unpack some of the core criticisms of Solana and present the bull case for the chain as we move into 2023:

1. Downtime & Outages

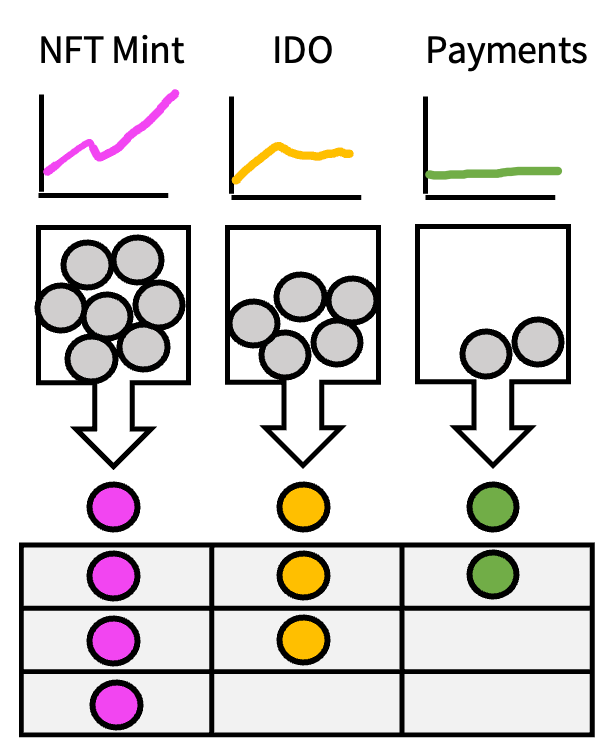

In 2021, Solana went from thousands of users to millions. This meteoric rise was accompanied by over 100 billion transactions. This level of traffic and activity has come with its own challenges. It is not an exaggeration to say that Solana, as a network, has been put under larger stress tests on single day(s) than all other blockchains combined. As Solana’s user and developer communities blossomed in 2021, the ecosystem began to offer many highly profitable and +EV activities ranging from NFT mints, to token IDOs, and price arbitrage. Minimal fees of $0.00025 per transaction meant that it was highly economic to spam the network with millions of requests per second with bots to extract as much value as possible. This issue was so severe at times that Cointelegraph reported a DDoS attack in September 2021 because of the sheer amount of activity surrounding an IDO. It wasn’t a denial of service attack but rather DDoS levels of of requests (~100GB/s) that caused an outage in the network lasting 17 hours. Critics were all too happy to spin the narrative that Solana is “constantly down”, even falsely claiming that the Solana team can turn the network on and off at will. Below we present some of the facts to refute these claims:

The Facts on Downtime & Outages

- Solana has had 99.6% uptime throughout its history while doing more true TPS

(excl. voting & communication transactions) than all EVM-based chains combined - The worst month of uptime was 96.4% in January 2022

- Solana has had 4 total outage events in the last 2 years

- Solana holds itself to a different standard, doing a block every ~400 milliseconds meaning that if it does not produce a block in a few seconds it is technically considered to be “down”, but this is still faster than Ethereum’s blocktime of 12s or Bitcoin’s 10 minutes

- Solana website status.solana.com details historical uptime, month by month from March 2021 until today:

What is Solana & Community Doing to Prevent Outages?

Many argue that anything less than 99.9% uptime is unacceptable, and we agree. To this end, there are a number of initiatives being implemented to reach that number

- Local fee markets (LIVE on Mainnet-beta) allow particular hotspots (like a NFT mint or IDO) to have fees unique to their activities (and piece of contentious state), there is no reason why a NFT mint should drive up the tx cost of another, unrelated activities such as DeFi or gaming, and Solana uniquely enables this:

- QUIC (LIVE on Mainnet-beta) gives validators more control over how many transactions they can receive by capping the flow to, say, 1GB instead of trying to process ridiculously large amounts of data like when bots spammed 100GB/s

- Stake-Weighted Quality of Service (QoS) (LIVE on Mainnet-beta) guarantees that every validator has some stake-weighted amount of voice, preventing people from flooding the leader node with overwhelming amounts of data

- Firedancer (Work in Progress) is a second validator client being built by Jump Crypto. We are including it under the Downtime section because once Firedancer goes live, it will provide huge redundancy and performance increases (more on this later). It is extremely unlikely there is a bug in both the original Solana client and the Firedancer client simultaneously, in effect reducing downtime to 0.

Since the trifecta of QUIC, Stake-Weighted QoS, and Local fees have been enabled, there has not been an outage or downtime event. We fully expect these initiatives, combined with Firedancer to result in virtually 100% uptime in the future, however if additional edge-case bugs are uncovered they will be addressed promptly, increasing the robustness of the network.

2. Centralization & Censorship Resistance

The conversation around (de)centralization is a somewhat slippery one, as it often devolves into a somewhat philosophical and ideological discussion. Legacy blockchains such as Bitcoin and Ethereum have solved for redundancy and guaranteed settlement over throughput & performance. Many people view blockchains through the lens of the earlier chains and believe performance and decentralization are mostly incompatible on the L1. Solana brings innovations around data propagation, execution environment, and consensus that challenges this notion.

For the purpose of this handbook, we will focus on quantifiable metrics of decentralization & censorship resistance:

- Full node count for recoverability of the ledger, with geographic diversification, a higher number is more decentralized. One of the key determinants of how many full nodes there are is cost. The most accessible the node cost is, the higher the node count

As long as one independent copy of the ledger exists, the ledger (history of transactions) can be recovered and rebooted - Stake distribution (Nakamoto Coefficient, NC) measures how many independent parties would have to collude to pool 33% of the stake weight, a higher number is more censorship resistant

(Solana has a NC of 30, Ethereum has a NC of 2 per Nakaflow.io)

The Facts on Centralization & Censorship Resistance

- Solana has 3,474 full nodes at the time of writing and Ethereum has 9,340 full nodes per validators.app and Etherscan

- The cost of a SOL node is the cheapest possible cost to achieve what Solana is aiming to do, a global synchronized price discovery engine with consensus at the speed of light

We reached out to Michael Laine of StakeWiz, one of the most veteran validator operators for a cost estimate for running a node and purchasing the hardware, and subscription starts at $350/month with the hardware costing $3.5k and up to buy outright

We also note that there is no possibility of 3rd party stake on Ethereum, meaning 32 ETH is required in order to participate in consensus. On Solana, a validator can start with <1 SOL of stake and achieve breakeven in 1-2 months with the help of Stake Pools and Solana Foundation’s delegation program - Solana has a Nakamoto Coefficient of 30 which means that 30 independent entities would have to collude to censor transactions (per Nakaflow.io)

- Since migrating to PoS, Ethereum has a Nakamoto Coefficient of 2 (Lido & Coinbase) per Nakaflow.io

- Solana is a newer chain relative to Bitcoin or Ethereum, and will continue to add full nodes, and decentralize its stake weight further over time

3. Inflationary Tokenomics

Solana has been criticized for having inflationary tokenomics, with 3 main Inflation Schedule Parameters as follows:

- Initial Inflation Rate: 8%

- Dis-inflation Rate: −15%

- Long-term Inflation Rate: 1.5%

Solana is inflationary by nature, with 15% disinflation targeting a long-term inflation rate of 1.5%. Please note, these numbers represent an upper bound limit on the amount of SOL issued from inflation, and do not account for other factors that could impact total supply such as fee/rent burning, slashing or other unforeseen future token destruction events.

At 1.5%, Solana’s daily staking rewards are $156k per day in inflationary rewards ($3.8Bn staking market cap * 1.5% APY / 365 days). Taking today’s daily revenue of $11.7k, there needs to be a ~13x increase in revenue to even out the effects of inflation

These increases in Solana’s revenue could come from 4 main paths:

1. Increase in network usage (more transaction fees as adoption & usage increases)

2. Priority Base Fees (users can pay increased fees for priority block inclusion)

3. Neighborhood Congestion Fees (higher fees applied to txs with congested contracts)

4. Miner Extractable Value (MEV) (daily arbitrage & liquidation transactions)

As shown, Solana has a clear path to reaching its long-term inflation rate of 1.5%, and we expect revenue to increase with usage, adoption, and priority & congestion fees and MEV all being significant revenue drivers for the network in the future.

4. FTX & SBF Chain

Solana has been referred to as the “FTX chain” in the past but it is important to give a bit of publicly available historical context when describing the relationship between FTX and Solana and why this is not an accurate description. Solana and FTX were first connected in 2020, around the beginning of ‘DeFi Summer’ when FTX was just beginning to enter the top 10 rankings of CEX volume. Solana founders and team had already put in ~2 years of engineering work and blockchain design completely independently of FTX prior to this initial meeting.

What Was FTX’s Relationship With Solana?

- FTX/Alameda were early investors in Solana and held a sizable portion ~10% of coins, which are now locked in bankruptcy proceedings

- FTX devoted some of their engineering resources to Solana in the early days of the ecosystem, building Serum, a base level DEX and Sollet, the first wallet infrastructure

- FTX made venture investments in a number of Solana native dApps and protocols and also significant investments into some of Solana’s competitors including $30M in NEAR, $50M in Polygon, $75M in Aptos, and $100M in Sui

See Alameda Balance Sheet below:

The Facts on FTX & Solana

- FTX had an outsized impact in helping kickstart the Solana ecosystem early on by extending its engineering talent, liquidity, and investments to SOL, notably Serum

- After this initial period of support, FTX’s commitment, both in terms of investment and in terms of engineers, declined, and FTX made sizable investments in multiple other competitors, including NEAR, Polygon, Aptos, and Sui

- When FTX filed for bankruptcy, Serum was forked because FTX still held upgrade authority, and members of the Solana community stepped in to take over the project

Solana was always a completely separate & decentralized network that in no way resembles the relationship between Binance and Binance Smart Chain (BSC). In the case of BSC, Binance controls the validator set and has total control over the chain, this does not even remotely resemble Solana

Looking Ahead to 2023 and Beyond

As important as it is to be armed with the latest information to combat baseless narratives and misinformation, it is critical to keep looking ahead to the next 1-2 years and what some of the key catalysts for Solana are that can result in significant user activity & value accrual

We have identified multiple things we are incredibly excited about that uniquely leverage Solana’s unique technology:

1. Firedancer:

TL;DR This software greatly improves performance up to 600k TPS at 1.2GB/s targeting 10GB/s and dramatically reduces downtime

Firedancer is a fully independent validator client for Solana built by Jump’s lead researcher Kevin Bowers (ex-Bell Labs). Firedancer works to increase both performance and reliability. Firedancer’s architecture utilizes individual C processes called tiles. This allows for modular upgradability and zero-downtime upgrades.

We have written extensively about why data propagation matters if your objective is to support mass-adoption

This isn’t only one of the biggest engineering initiatives on Solana, it’s one of the most significant projects in all of crypto…

2. Solana Mobile Stack (SMS)

TL;DR This is about the knock-on effects of taking crypto & Web3 to mobile at scale and unlocking new patterns of behavior from users to enable mass adoption

SMS disrupts the traditional Web2 distribution avenue of App/Play Store with predatory terms and censorship and creates the possibility for truly decentralized mobile apps. One of the most significant hurdles in getting hundreds of millions or billions of crypto users is building mobile first experiences and enabling private key (seed phrase) management within the secure enclave on people’s mobile devices. Solana Mobile is less about the physical SAGA phone and more about the second order effects of enabling a Web3 mobile experience at scale.

3. xNFT Backpack

TL;DR This is the best wallet in all of crypto, it’s a cross-chain Web3 operating system similar to iOS but open source, enabling a flywheel of developers and users

Armani Ferrante, founder of Coral (parent company of Backpack) has a proven track record of improving the developer experience on Solana drastically with Anchor. He is taking this knowledge and experience full-stack by building an open platform where anyone can submit a PR (pull request) to have changes implemented. This allows innovation to compound faster than ever before, because clever teams don’t have to cross their fingers and hope that a Phantom or Metamask of the world decides to integrate their product.

If you can dream it, you can build it in Backpack and add it to the xNFT store. Did we mention it is cross-chain too? SOL and ETH are already live, with other chains coming. In a time where most wallets only worry about users, Armani & team are tackling developer and user experience at the same time…

4. NFT Token Compression

TL;DR Soon you will be able to mint and distribute 100M (100,000,000) NFTs for <$2k USDC

Solana’s tech and minimal gas fees will not only uniquely enable the minting of these NFTs but also the ability to trade them on secondary virtually for free ($0.00025/tx). Think about the applications for gaming with DePIN, microtransactions, social media, messaging, payments, even mainstream consumer brands, and governance infrastructure. The sandbox for developers is about to get a LOT bigger…

5. Seahorse / Move / Solidity

TL;DR You can already compile Python to Rust artifacts and Anchor Lang with Seahorse, Move & Solidity coming soon

The cornerstone of any ecosystem are developers. They build the products and applications that bring the masses, hence the phrase “follow the builders”. Solana will introduce compilers that make the process for developers of other languages to seamlessly start writing code in Rust easier than ever. Programming languages are not a sustainable moat or competitive advantage long-term, and any code that makes writing code easier compiling other languages down to Solana byte code to make things more bug-free is very welcome. Even Rust on its own is consistently ranked at the top of most-loved programming languages every year by millions of devs.

Most people don’t put in the time or effort to digest & understand the latest information from multiple sources and instead rely on narratives and secondary information from others. We have gone directly to the source to address the main critiques of Solana head on and end 2022 on an optimistic note with the strong tailwinds the network will enjoy in the coming months and years. It’s been a tough year for Solana but we are very confident the best is yet to come.

Disclosure: Frictionless Capital is an investor in xNFT Backpack.

Legal Disclaimer:

This article does not constitute investment advice and is not intended to be relied about as the basis for an investment decision, and is not, and should not assumed to be complete. The contents are provided for informational purposes only and are not to be construed as advice, any prospective investor should conduct their own research and could lose all or a substantial portion of its investment.